Climate Finance Needs: Insights from the Partnership

Introduction

As countries work with the NDC Partnership to revise and enhance their nationally determined contributions (NDCs), many are treating the process as an opportunity to engage with key financial players by developing bankable and ambitious climate projects. Particularly for developing countries, increasing access to climate finance is a critical component to supporting the implementation of their NDCs at the pace necessary for achieving the goals of the Paris Agreement. In anticipation of the next round of NDCs, the NDC Partnership has published an insight brief in English and Spanish, which reflects on the last three years of member country finance requests and explores opportunities to strengthen support and accelerate response going forward.

Key Points

- 90% of NDC Partnership member countries make requests which explicitly address financing needs, with most countries indicating need for support to develop bankable projects or project pipelines, and to integrate NDCs into planning, national budgets and revenue.

- Across the board, technical assistance makes up the majority of country requests (71%), underlining the Partnership’s role in building in-country capacity.

- The NDC Partnership responds to these requests by connecting partners with countries to identify financing mechanisms, map financial resources at the domestic and international levels, and cost NDCs to lay the groundwork for project and program implementation.

- For a more in-depth analysis, see the NDC Partnership’s insight brief on ‘Understanding NDC Financing Needs’.

What Finance Requests Is the Partnership Receiving?

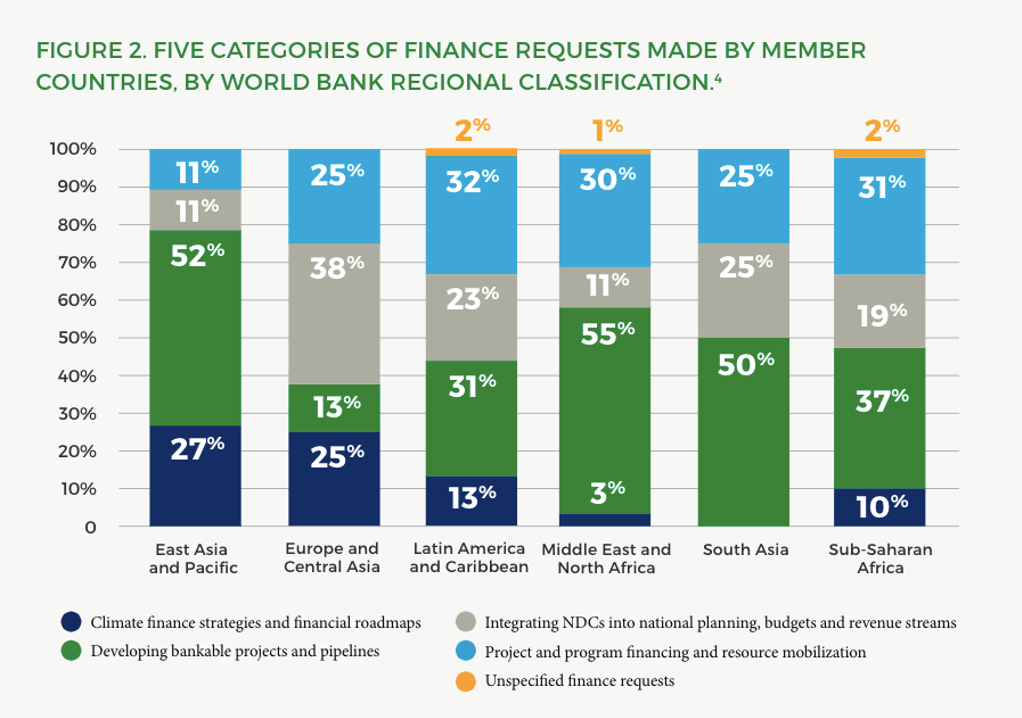

NDC Partnership countries generally request finance support in five categories, which are outlined in Figure 1. Across all these categories, requests are aimed at strengthening national ownership and prioritization of climate financing, improving resource mobilization, and unlocking new financing opportunities.

To better understand the demand across these five categories, the NDC Partnership analyzed the finance-related needs of 34 member countries. Nearly 90% of countries who make requests to the Partnership explicitly address financing needs. Most of these needs relate to project and program financing and resource mobilization, focused on enhanced access to climate finance through blended finance mechanisms and financial vehicles. Requests for developing bankable projects or project pipelines are also extremely prevalent, with needs centered around support for technical and economic feasibility assessments for specific projects or proposal development.

Moreover, 76% of countries demonstrate a considerable need to integrate NDCs into planning, national budgets and revenue, and over half of all countries frequently request technical support to develop climate finance strategies. Requests are largely focused on capacity building activities which mainstream climate finance considerations into government operations, and allow governments to assess, mobilize, and track public and private funds for climate change related purposes.

Across the board, technical assistance is requested most often by countries (as opposed to requests for direct project funding), underlining the central importance of building in-country capacity to mobilize external climate finance as a supplement to public funding. With 98% of countries seeking technical assistance to integrate NDCs into national planning and budgeting, the NDC Partnership has made capacity building activities a priority area for targeted support.

How is the Partnership Responding?

The NDC Partnership leverages on its membership network to connect countries with partner support to prioritize and cost NDCs, map financial resources at the domestic and international levels, and identify funding sources and financing mechanisms that will unlock finance for project and program implementation. For example, the NDC Partnership has recently teamed up with the Green Climate Fund (GCF) to support the integrated and coordinated development of the countries NDC Partnership Plan and it’s GCF Country Programme. The Partnership also assists countries in the translation of their costed NDCs into strong investment proposals aligned with national development plans. For example, the Partnership has delivered support for Mali’s development blueprint—the Strategic Framework for Economic Recovery and Sustainable Development 2019-2023—which incorporates international and domestic sources for sub-national and sectoral needs.

Furthermore, the Partnership uses its unique knowledge base to identify and share potential investment opportunities in member countries. Building off projects mapped out in Partnership Plans, the Partnership works with country partners to identify unsupported and existing projects which are at the feasibility stages and help gauge interest from potential investors or institutional partners that can assist with developing financial readiness or financial structuring.

What’s Next

NDC finance will remain a central focus area of the Partnership as countries work to develop ambitious, yet feasible NDCs in the coming year. For more information on country finance requests and the Partnership’s response, reference our latest insight briefing 'Understanding NDC Financing Needs'.

This blog was written by Sam Morton of the NDC Partnership Support Unit.