Unlocking Private Finance to Help Governments Achieve their Climate Goals

The historic Paris climate change agreement entered into force at record speed in November 2016, committing countries to a decarbonized future. To date, nearly 190 countries have submitted Nationally Determined Contributions (NDCs) targeting aggressive growth in climate solutions—including renewable energy, lowcarbon cities, energy efficiency, sustainable forest management, and climate-smart agriculture. The NDCs offer a clear roadmap for investors and companies looking for profitable investments in climate-resilient infrastructure and assets.

There has never been a better time to invest in climate business. Massive cost reductions have made solar photovoltaic (PV) and wind power mainstream. Global investment in clean energy in 2016—nearly $350 billion—was more than double the amount invested in coal- and gas-fired power generation.2 At the same time, farmers are investing in more productive, climate-resilient agricultural practices, and the green buildings market has doubled every three years for the past decade.3

CLIMATE BUSINESS IS A SIGNIFICANT INVESTMENT OPPORTUNITY

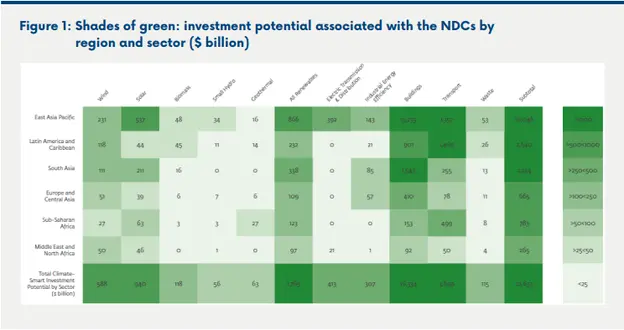

To size the investment opportunity associated with NDC targets, the International Finance Corporation (IFC), a member of the World Bank Group and the world’s largest private sector development bank, analyzed national climate commitments made in Paris by 21 emerging market economies where we expect major investment in infrastructure and climate-smart solutions (Figure 1). While the focus of this analysis was on mitigation opportunities, adaptation, resilience, and risk management were integral to most of the NDCs submitted. Further details on the analysis and policy recommendations outlined here are available in the recent IFC publication Climate Investment Opportunities in Emerging Markets. 4

This expert perspective is part of a series that invites internationally recognized experts to explore key issues countries face as they implement their Nationally Determined Contributions (NDCs) under the Paris Agreement on climate change. The views expressed are the authors’ own, and do not necessarily represent the views of the NDC Partnership Support Unit, its member countries or organizations. Read the series at www.ndcpartnership.org/ perspectives

IFC found a $23 trillion investment opportunity to 2030 if these countries achieve their ambitions to scale up solar and wind energy, increase green buildings, put in place clean transport, and implement waste solutions as laid out in their NDC commitments. Highlights include:

- Green buildings in East Asia—China, Indonesia, the Philippines, and Vietnam have a climate-smart investment potential of $16 trillion, most of which is concentrated in the construction of new green buildings.

- Sustainable transport in Latin America— Argentina, Brazil, Colombia, and Mexico have an investment potential of $2.6 trillion, almost 60 percent of which is for transport infrastructure.

- Climate-resilient infrastructure in South Asia—Bangladesh and India have an investment potential of about $2.5 trillion, which is concentrated in the construction of green buildings, ports and rail transport infrastructure, and energy efficiency.

- Accessible, clean energy in Africa—Cote d’Ivoire, Kenya, Nigeria, and South Africa’s total investment potential is nearly $783 billion, which is spread across renewable energy generation ($123 billion) and buildings and transportation ($652 billion).

- Energy efficiency and transport in Eastern Europe—Russia, Serbia, Turkey, and Ukraine’s estimated climate-smart investment potential is $665 billion, with more than half of that focused on new green buildings. Energy efficiency is a priority sector, while renewable energy investments are only beginning to accelerate.

- Renewables in the Middle East and North Africa—Egypt, Jordan, and Morocco’s total climate-investment potential is $265 billion, over one-third of which is for renewable energy generation ($96.7 billion), while 55 percent ($146 billion) is for climate-smart buildings, transportation, and waste solutions.

It is important to note the $23 trillion estimate covers public and private investment needs; by most assessments, the private sector will need to deliver the lion’s share of capital for climate-smart infrastructure given the magnitude of finance needed and competing demands on limited public resources.

A CLEAR BUSINESS CASE FOR PRIVATE SECTOR INVESTMENT IN CLIMATE

The business case for immediate action is clear both from a financial and a risk management perspective. Companies are increasingly recognizing the need to ensure that their operations are resilient against supply chain disruptions and other effects of climate change.

As a result, forward-looking businesses are now moving quickly to climate-smart investments that are good for the bottom line instead of waiting for political action and signals. Investments in energy efficiency continue to yield financial returns with energy consumers gaining almost $5.7 trillion in returns over the last 25 years. Private sector-led initiatives such as the Task Force on Climate-Related Financial Disclosures5 are driving the agenda, often ahead of public policy, and framing the way companies manage and disclose their operational and financial exposure to climate change.

Although private investors are increasingly concerned about the impacts of climate change on the value of their investment portfolios, they still require investment opportunities that are a suitable size, meet their riskreturns hurdles, and offer adequate risk diversification and liquidity. This will require a pipeline of marketable projects, green financial instruments, and—most importantly—complementary public finance.

Roll-out and funding of national NDC programs has the potential to provide an exceptionally attractive pipeline of private investment opportunities. If governments make good on their NDCs by implementing a set of clear, investment-friendly policies, business will help to unlock trillions of dollars of investment. The private sector is ready to engage with governments to figure out the most efficient, low-cost ways to deliver on their NDCs.

To unlock private investment, governments must prioritize actions across three pillars: climate policy, investment climate, and enabling financial innovation with public finance. All three pillars need to be emphasized and acted on in parallel.

- Get climate policies right. Countries should act quickly to align their institutions and policies across sectors by integrating their NDC commitments into national development strategies, and budget and staffing processes. This will help governments move from often high-level NDC targets to establish implementing regulations with clear and consistent policies such as carbon pricing, performance standards, market-based support, and removing fossil fuel subsidies, to ensure that climate considerations are integrated into other sector policies.

- Strengthen the private sector investment climate. Companies will first identify if a country’s investment climate and banking sector are attractive as they look for investment grade opportunities to finance. Enforcing property rights, providing a robust framework for public-private partnerships, and creating investment policies and incentives will all help to minimize unnecessary costs and reduce risks to attract private capital towards these newer sectors. The World Bank Group’s annual Doing Business Report6 is a useful tool to assess the overall state of the investment climate in countries. Enabling the financial sector to direct resources towards climatefriendly investments is key for ensuring companies realize the opportunities identified here.Jordan’s policies and enabling conditions drive renewable energy investment

Jordan’s renewable energy law was complemented by feed-in tariffs, 20-year power purchase agreements (PPAs) with standardized contracts including tariff adjustment mechanisms for inflation and exchange rate variation, and a 10-year income tax holiday with a lower tax rate. The government also provided a sovereign guarantee to back-stop the buyer’s payment obligations under the PPA. This mix of policies, processes, and incentives is transforming power generation in Jordan7 and resulted in the 117 megawatt (MW), $290m Tafila Wind Farm—the country’s first privately owned renewable energy facility. This is being followed by 12 solar projects with power purchase agreements totaling 190MW—the largest private sector-led solar initiative in the Middle East and North Africa

-

Strategically use limited public finance. Government budgets will not be enough to address climate change. Governments should strategically target their limited public funds to de-risk and aggregate investments, strengthen capital markets, address bottlenecks, and support project development to mobilize private capital. Blended, concessional public finance provided through a variety of products and structures such as risksharing facilities and lower interest rates can play a significant role in unlocking private finance.

Financial innovation is needed to attract private sector investment at the scale needed to fund the transition to a low-carbon economy. The de-risking and aggregation of smaller assets into larger pools can create instruments attractive to institutional investors for whom scale is key. The Scaling Solar program streamlines project preparation in multiple emerging markets, helping accelerate the development of new solar projects and make them operational in only two years. Similarly, new platforms and partnerships with financial intermediaries are scaling up green buildings, green factories, and climate smart agriculture. The green building assessment tool, EDGE, is available in 125 countries and is a simple system to build and certify green—a $16 trillion opportunity through 2030. 8

Several financial innovation platforms have been established to develop new approaches to climate finance, including the Global Innovation Lab for Climate Finance, which designs financial mechanisms and structures with the aim of attracting institutional investors. Another example is the Catalytic Finance Initiative (CFI),11 which is a partnership of banks, asset managers, supra-sovereign agencies and foundations that have joined forces to increase financing and investment for high impact projects around the globe by sharing their expertise and risk appetite. The CFI targets is to mobilize at least $10 billion of additional funding by 2022 through their combined efforts.

Financial innovation for tackling climate change

Green bonds enable corporations and banks to raise capital for climate friendly projects, and the market has grown significantly since the first green bond was issued in 2007 to a record $81 billion in 2016, almost double that of 2015. The market is diversifying with bonds from an increasing number of countries, different issuer types, and ratings. Recently, we have seen two countries issue sovereign green bonds, thus the green bond could become an important investment vehicle to help finance NDCs. IFC issued a 5-year, $152 million Forests Bond12 on the London stock exchange in November 2016. The bond gives investors the option of getting their interest paid in either carbon credits or cash. The proceeds will support IFC’s private sector lending in emerging markets, and provides an important new financial product for this important sector.

NEXT STEPS: THE ROLE OF THE NDC PARTNERSHIP

Hard work is required to put the necessary policies and financial innovations in place. It will also require more partnership, coordinated action and leadership among government, business and civil society. This is where the NDC partnership can play a key role.

Through its multi-stakeholder approach, the NDC Partnership can help unlock private finance for NDCs in a number of ways, including:

- Hosting targeted public-private dialogues convening companies, financial institutions, and regulators as one approach to engaging the private sector to prioritize overcoming barriers and challenges preventing investment;

- Using dialogues to flesh out collectively agreed roadmaps for implementation of solutions targeted to specific sectors;

- Supporting countries in turning their NDCs into an investment-ready pipeline of marketable projects;

- Supporting NDC implementation by developing tailored financial solutions that strategically use limited public funds; and

- Facilitating exchange of experiences and lessons learned across the partner countries to support the use of best practices

ENDNOTES

1. Special thanks to IFC Climate Business Department colleagues Berit Lindholdt Lauridsen and Steven Baillie for their input

REFERENCES

2. Bloomberg New Energy Finance (2016), Clean Energy Investment Fact-pack, Q3 2016 https://about.bnef.com/clean-energyinvestment/

3. Dodge Data & Analytics (2016), World Green Building Trends Study http://analyticsstore.construction.com/smartmarketreports/2016WorldGree…

4. International Finance Corporation (2016), Climate Investment Opportunities in Emerging Markets http://www.ifc.org/wps/wcm/ connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/new+ifc+report+points+to+%2423+trillio n+of+climate-smart+investment+opportunities+in+emerging+markets+by+2030

5. Task Force on Climate-related Financial Disclosures https://www.fsb-tcfd.org/

6. World Bank, Annul Doing Business Report http://www.doingbusiness.org/

. International Finance Corporation (2013), IFC Finalizes $221 Million Debt Package for Ground-Breaking Wind Farm in Jordan http://ifcext.ifc.org/IFCExt/pressroom/IFCPressRoom.nsf/0/41F0C8F1C2A2D….

8. International Finance Corporation, Excellence in Design for Greater Efficiencies https://www.edgebuildings.com/.

9. International Finance Corporation (2016), Climate Investment Opportunities in Emerging http://www.ifc.org/wps/wcm/ connect/51183b2d-c82e-443e-bb9b-68d9572dd48d/3503-IFC-Climate_Investment_Opportunity-Report-FINAL-11_6_16.pdf

10. The Global Innovation Lab for Climate Finance, http://climatefinancelab.org/

11. See http://newsroom.bankofamerica.com/press-releases/environment/catalytic-…-

12. International Finance Corporation (2016), IFC Marks The Listing of World’s First Forests Bond on London Stock Exchange http:// www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_sit…

ABOUT THE AUTHORS

Tom Kerr, Principal Climate Policy Officer

Aditi Maheshwari, Climate Policy Officer, IFC Climate Business Department

LEARN MORE | The The NDC Partnership is a coalition of developed and developing countries and international institutions working together to ensure countries receive the technical and financial support they need to achieve ambitious climate and sustainable development targets as fast and effectively as possible. Visit ndcpartnership.org