Three Stages to Strengthen NDC Investment Planning: A Guide from the NDC Partnership

The ability to identify, prepare, and implement transformative large-scale mitigation and adaptation projects and mobilize unprecedented amounts of capital will be central to achieving the Paris Agreement. Not only is the investment gap large, but finance needs to flow faster. Approximately USD 125 trillion is needed globally by 2050 to reach net-zero, representing annual investments of approximately 4% of the world’s GDP. In order to meet this target, investment from now to 2025 needs to triple compared to the last five years.

On the adaptation front, the impacts and investments needed are also critical. The International Monetary Fund estimates that direct damage from climate impacts costed USD 1.3 trillion from 2010-2019 and forecasts from the European Central Bank indicate that climate change could impact GDP in a range of 1-3.5% by 2060 and 2-10% by 2100.

The Nationally Determined Contributions (NDCs) are the cornerstone of global climate action. Through reflecting national commitments from developed and developing countries, NDCs build towards the Paris Agreement’s goals to limit climate change and build resilience and adaptive capacity. NDCs constitute a powerful starting point for translating countries’ climate commitments into investment actions, creating the basis and policy signals for a transition to a low-carbon economy and the achievement of the SDGs.

As a global coalition for climate action, the NDC Partnership is supporting countries to mobilize investments for NDC implementation. Currently, finance is the most frequently requested area of support from our members. To effectively respond to this growing demand, the Partnership launched its Finance Strategy in April 2022. Investment planning is core to this support. Based on consultations with partners, literature review, and a collection of best practices from country members, the Support Unit has put together an NDC Investment Planning Guide to help strengthen and simplify the investment planning process.

Simplified Investment Planning Guidance for Countries

To facilitate matchmaking with financiers, investment plans must have the relevant information needed to mobilize resources for the achievement of NDC targets. At the same time, ensuring common frameworks and language can be a powerful tool to better articulate needs and opportunities to provide more programmatic support responses.

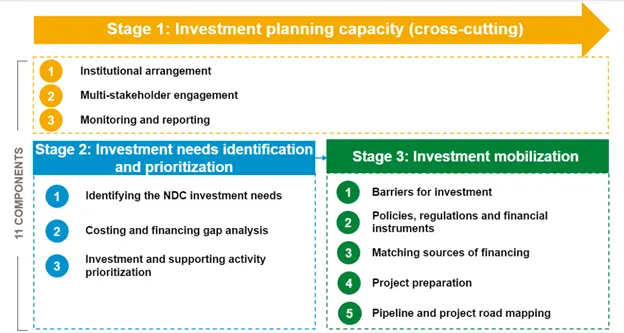

The NDC Investment Planning Guide provides a basis for countries to design and advance their NDC investment planning, recognizing the process as dynamic and iterative, dependent on each country’s ambition, and capabilities. Specifically, the guide lays out three stages through which countries can approach their investment planning. Each stage is broken down into specific components. While the guide presents this process in a linear format, countries will start at different stages, and follow different orders based on their unique needs.

The three stages of investment planning include:

- Investment Planning Capacity – to ensure structures and institutional systems are in place to develop and action NDC investment planning.

- Investment needs – to identify needs, costs, gaps, and priorities in NDC financing.

- Mobilizing investment – to identify existing barriers and sources of financing for NDC investment needs.

Stage 1: Investment Planning Capacity

The first stage of NDC investment planning is cross-cutting and sets out the institutional arrangements that facilitate identifying and prioritizing investment needs (stage 2) and mobilizing investment (stage 3) across sectors, with appropriate contributions from stakeholders.

Building the necessary capacities is critical for the success of NDC investment planning. First, establishing institutional arrangements is important to ensure strong accountability and collaboration channels within government. This can include mandating leadership within existing institutions, in a new unit, or in the establishment of a specialized unit. Second, multi-stakeholder engagement across all elements of NDC investment planning facilitates stakeholder buy in and collaboration, not only in the planning phase, but also once implementation and resource mobilization kick off. Finally, monitoring ongoing and planned financial flows is an important process to ensure there are sufficient resources distributed appropriately to meet climate objectives, while reporting can provide significant input for future iterations of NDC investment planning outputs.

In Belize the government established the National Climate Change Committee (BNCCC), a new governance structure, to oversee and coordinate inter-ministerial climate action. More recently, Belize has taken concrete steps to set up a new Climate Finance Unit to lead project development work and put in place a comprehensive measurement, reporting and verification (MRV) system to track climate finance flows and utilization. These arrangements have been critical in building the foundation for translating NDC priorities into concrete investment opportunities and ensuring communication and cooperation across ministries and other key stakeholders.

Photo: Aerial Drone view of South Water Caye tropical island in Belize barrier reef

Stage 2: Investment Needs Identification and Prioritization

The second stage for NDC investment planning involves identifying the country’s investment needs. Investment needs can then be costed, the financing gap determined and prioritized.

NDC investment needs include a well-defined set of investments and supporting activities (e.g. technical assistance and capacity building) that unlock the mitigation and adaptation actions required to achieve the NDC targets. With this information, countries should identify any gaps relative to their latest NDC ambition. Sector and technical experts can review investments to assess if these align with the scale of action required to match NDC ambition.

From there, countries can cost and calculate the financing gap against the NDC investment needs. The gap is calculated by costing the current and future NDC investment needs and subtracting the level of funding already secured. Countries can then develop appropriate strategies to close the financing gap.

Next, prioritizing NDC investment needs facilitates the channeling of financing into areas which have the most potential for mitigation and adaptation, as well as alignment with broader national priorities. This process should be based on consistent and transparent multi-criteria assessment of the strategic alignment of investments, their contribution to achievement of the NDC and SDGs, and feasibility of delivery. Several countries have adopted measures to quantify the cost of NDC implementation, but few have combined this process with a prioritization exercise that allows to understand financing gaps, sequencing, and priority levels across actions.

Jordan’s experience demonstrates how to incorporate diverse views into the validation of investment needs and prioritize actions against concrete climate impact criteria aligned with development priorities. A sector working group comprised of ministry representatives, development partners, and civil society identified 35 priority actions to achieve the NDC targets, based on identified criteria (including impact, sustainable development potential, gender & vulnerability issues, and readiness of each action). This work translated into a list of specific project interventions, sequenced through cost-benefit analysis and stakeholder input.

Photo: Amman, Jordan

Stage 3: Mobilization of Investments

The final stage of NDC investment planning sets out how specific investment needs will be met, and creates the enabling environment required to facilitate the match.

Key components include identifying and sequencing barriers to mobilize resources and mapping regulations and financial instruments to improve enabling environments and address barriers.

To successfully catalyze finance for the identified gaps, NDC investment planning should include a comprehensive mapping of needs against available sources, including for instance, national, international, and private finance. The matching of needs and financing sources can then serve as a communication and coordination tool to mobilize investors, donors, and government officials.

From there, project preparation can take place, translating investment needs into specific investment projects that are ready for financing and implementation. While project ideas will have been identified throughout the different stages of the investment planning process, at this stage they move from idea to implementation-ready project. Moreover, when the NDC investment planning process includes specific projects, the plan can additionally include the definition of a pipeline, sorting opportunities by readiness and existing financing support.

Rwanda showcases how to translate planning priorities into NDC-aligned projects through a sequence of reviews, beginning with concept note preparation and progressing to a full feasibility study. Building on Rwanda’s NDC implementation framework, ministries put forward investment proposals for consideration, and once concepts are approved by the Ministry of Finance and Planning, the investment appears as a project in the Public Investment Management System. From there, feasibility studies are conducted to assess expected results, based on robust cost-benefit analysis, a mapping of project delivery and funding options, and a socio-economic impact assessment. The government then uses this information to make final approval decisions on investments, ensuring that what gets funded is not only feasible but helps the country advance achievement of its NDC targets.

Photo: Tropical Rainforest of Nyungwe National Park, Rwanda

The Way Forward

With the revised NDCs in place, and as countries scale up NDC implementation, NDC investment planning is a critical area that will benefit from further technical assistance, sharing of best practices, and strengthening of knowledge. NDC investment planning processes will be unique to each country, dependent on country status, capacity, and ambition of their NDC targets. Importantly, as NDC targets are revised and enhanced, investment plans will also need to be updated to meet new commitments. Through this flexible and simplified guidance provided by the NDC Partnership, countries and partners can collaborate through common language and frameworks to develop robust, dynamic, and achievable NDC investment plans.