Managing Uncertainty is Critical to Getting Climate Investments to Where They’re Needed Most

Despite the tremendous strains and related fallout from the global pandemic, private sector investors—particularly those in advanced economies—have ramped up their commitments this year to help contain and adapt to the effects of climate change.

In January, BlackRock CEO Larry Fink reported that his firm, which manages assets totaling USD7 trillion, will make environmental sustainability a core goal as it invests client funds. Citibank said it aimed to lend USD250 billion over the next five years to renewable power projects, green buildings, water conservation, and energy efficiency. And in June, global investors managing USD12 trillion wrote an open letter demanding that any COVID-19 recovery plan in Europe include vast investments in renewable energy and green technology.

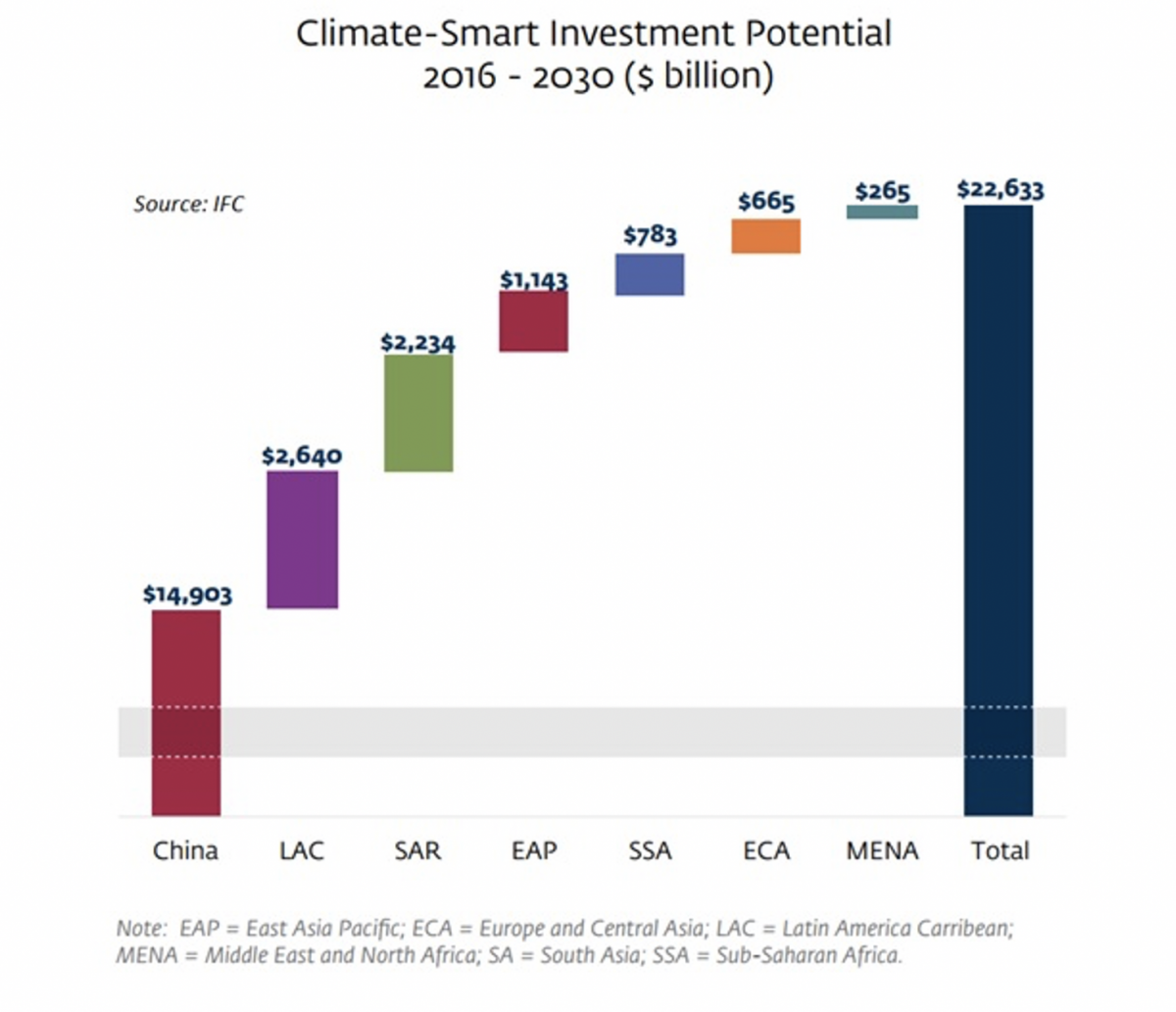

At the same time, the International Finance Corporation tells us that emerging markets offer a USD23 trillion opportunity for climate-smart investments. The growth in GHGs is expected to come primarily from emerging markets and investment possibilities are particularly strong for green building in East Asia, sustainable transport in Latin America, infrastructure in South Asia, clean energy in Africa, and renewables in the Middle East and North Africa.

Yet, in many cases, investor money is not reaching the sectors and emerging markets that need it the most.

The longer-term reasons for this center around the weak investment climate endemic to most low-income countries. These countries have room for improvement when it comes to effective and transparent business taxation, regulation, legal enforcement of property rights, frameworks for public-private partnerships, and proactive investment policies.

But looking a level deeper and to the more immediate term, a key challenge is finding individual, stand-alone projects in key sectors and regions that are bankable—and therefore investable. Bankability hinges primarily on designing a well thought out risk-sharing structure at the project development phase. If the risks are not allocated to the right parties during a project’s conceptualization phase, the ultimate consequence is the inability to find investors and lenders.

Project-related risks can take many forms, including:

- New or uncertain regulatory environments, including complicated

- Unclear renewable portfolio standards for clean energy.

- Weak creditworthiness or insufficient track records among public entities that act as suppliers, off-takers, or borrowers in the project.

- Political and other non-commercial risks.

The Multilateral Guarantee Agency (MIGA) has an important role to play in making projects bankable by addressing some of these risks through its political risk insurance and credit enhancement products. At MIGA, we promote private investment in developing countries by helping manage uncertainty in these key dimensions of project development. We have supported climate mitigation and adaptation projects in wind, solar, hydro, green buildings, public infrastructure, forestry, and waste management, among other sectors.

Our guarantees have helped deliver real climate impact on the ground, including:

- Avoiding the release of 10.4 million metric tons of CO2e per year.

- Helping developing countries mobilize USD7 billion in private capital for climate projects.

- Supporting USD2 billion in projects producing a total of 5 gigawatts of green power.

MIGA is a key member of the NDC Partnership as it supports creating the framework conditions and de-risking mechanisms that enable project financing in several countries where the Partnership is working. The NDC Partnership Support Unit and MIGA have been collaborating to identify projects and initiatives to support through MIGA’s products and services. For instance, incorporating guarantees into project design could make projects associated with NDCs bankable and mobilize private sector participation without the need to increase sovereign guarantees that reduce countries’ fiscal spaces.

Some key projects MIGA supported in recent years include:

- Egypt, 2019: A 250 MW wind farm owned by Lekela Egypt Holdings and insured by MIGA against losses of up to USD122 million for 20 years.

- Malawi, 2019: A 60 MW solar PV project in Salima province of Malawi, MIGA issued guarantees to JCM Power International and InfraCO Africa Ltd amounting to US$ 58.58 million to cover equity investments, for 20 years. The project is one of the first Independent Power Producers in the country.

- Solomon Islands, 2020: MIGA insures a USD15 million investment in a hydropower plant, where power is expensive and unreliable, for 20 years.

- Senegal, 2018: Taiba N’Diaye, the largest wind farm in West Africa, providing 450,000 MWh of electricity per year to 2 million people, backed by USD149.80 in MIGA guarantees.

- Panama Metro, 2014: Line 1 of the Panama City metro system, completed in 2014 and backed by a USD320 million, 12-year guarantee from MIGA.

A specific case study demonstrating how we made a project more bankable is a wind farm in Djibouti. The country is blessed with strong, consistent wind and half the population has no access to electricity. That combination of enormous supply and enormous demand creates a major opportunity. However, Djibouti is a challenge for investors because a fifth of the population lives below the poverty line and the country relies on imports for almost all of its food.

Climate Fund Managers, a Dutch investment firm, wanted to build a wind farm in Djibouti, but the political and social risks made its bankability questionable. They turned to MIGA for a guarantee on their investment and the agency backed 90 percent of it with guaranteed payment of earnings from the project for 20 years, for a total of USD92 million.

Such projects only scratch the surface of MIGA’s capabilities. Along with the rest of the World Bank Group, the Agency is targeting the goal of at least 35 percent of all new insurance given over the next three years goes toward supporting climate finance.

While well-intentioned investors are eager to address one of the most pressing challenges of our time, and countries across the world are keen on recovering from the pandemic by building back better, they continue to experience challenges when it comes to connecting with each other. Reliable, well-structured, and bankable projects are a key link that can help make this happen. Understanding and mitigating the risks associated with developing projects is key to helping money go where the opportunities are.

This blog was written by the Multilateral Investment Guarantee Agency (MIGA), a member of the World Bank Group providing political risk insurance and credit enhancement.